All things considered… we don’t know what we don’t know

Joe Fernandes | GQF Group | 03 July 2020

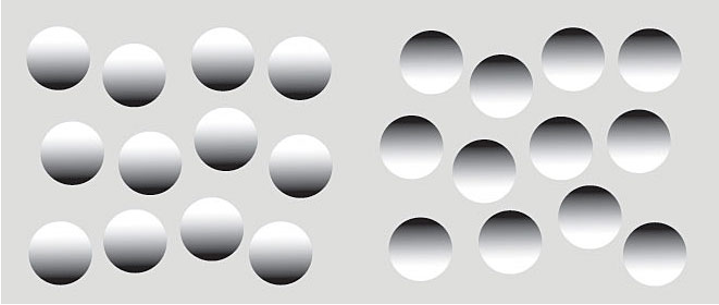

What do you see in the image below? Most people perceive a series of raised dots on the left, and a series of recessed cavities on the right. Turning the image upside-down flips the recessed cavities into raised dots, and vice versa. You can try it now - print out and then turn the page upside down.

It is impossible to see both the left and right dots as being simultaneously raised or depressed. And our brains typically depict the left side as being raised. The reason is obvious - the shading in the image fools the brain into inferring shadow and therefore depth. We perceive the shadow as being cast by a single source of light. That is, when we look at this image, our brains seek consistency in interpretation of the whole (and with our world view). This would be the case if there was a single source of illumination. In this case, the illumination is coming from the top of the image.

What do you see?

Why do our brains interpret there being one source of light (and therefore only one series of raised dots) rather than two? The answer, at least in part, is that we are the beneficiaries of billions of years of evolution on a planet with a single sun.

The point of this exercise is that we make automatic assumptions, on a daily basis. Some of these are so deeply programmed into our minds (and many of them are useful) that it is genuinely difficult to identify when an assumption is being made - for example, that there is a single source of light and it comes from above. This is a significant cognitive bias. We believe what we see, and we structure our responses accordingly before asking ourselves whether we have, in fact, made any assumptions at all.

Assumptions are not a-priori bad. We need them in order to live our lives, plan for tomorrow, and organise ourselves. We live in the real world and the real economy. However, questioning assumptions is also fundamental to ensuring long-term, sustainable success because it fends off other pernicious cognitive biases - confirmation bias, social bias, and many others - that would otherwise limit, and often-times prevent, success.

How many assumptions are built into our investment strategies, which products we take to market, how they are managed, and how we interact with our clients?

One problematic assumption, for example, is that the best global investment solution is one that maximises locally across multiple domains. In other words, we might optimise within each sleeve of an investment portfolio while leaving aside the question of how the combined portfolio effort achieves the global objective. The same applies, at the larger scale, to an analysis of value-chains in our industry relative to its purpose. Piece-wise optimisation may provide the answer, but often does not.

Another critical assumption is that our pre-crisis investment management toolkit will remain relevant in the future. Consider our reliance on asset class diversification, client stability to underpin investment in long-term assets, and the structure of current governance models.

Questioning our assumptions leads us to a deeper understanding of our offers and, oftentimes, to innovation. In other words, it allows us to gain and provide assurance, and it allows us to continue to develop towards best practices. Both are important to the compact we have with our clients and members, and this is amplified by the current crisis.

It takes skill to constructively question the assumptions we make, many of which look like system constraints - but doing so is a critical ingredient to success.

Sustainable success requires an outwards perspective and, usually, an outside perspective, a constructive questioning of assumed knowledge within the enterprise and our industry.

Two questions follow. Do we know what we don’t know? How do we find out?

This is challenging. People living in a system often cannot conceive of a different world, like in Edwin A. Abbott’s Flatland.

The answer?

Question assumptions. Even those that feel like system constraints. Doing so effectively ensures a consideration of all that is possible, and therefore allows us to maximise value creation.

ABOUT THE AUTHOR

Joe Fernandes, PhD, is Principal and Founder of GQF Group (Sydney), and former Managing Director of First State Investments Asia.

"All things considered…" Portfolio Construction Forum webinar series starts Friday 24 July 2020

An upcoming Portfolio Construction Forum webinar series will examine which of our critical investment and portfolio construction assumptions remain valid, after having been challenged by yet another crisis - this time, the Covid-19 crisis. The series kicks off on Friday 24 July 2020 with an in-depth look at the topic of this article - All things considered… we don’t know what we don’t know - and identifies areas of our portfolio construction activities that require new thinking.

Join the debate

What’s your view? Answer the question and see how your view compares to others.